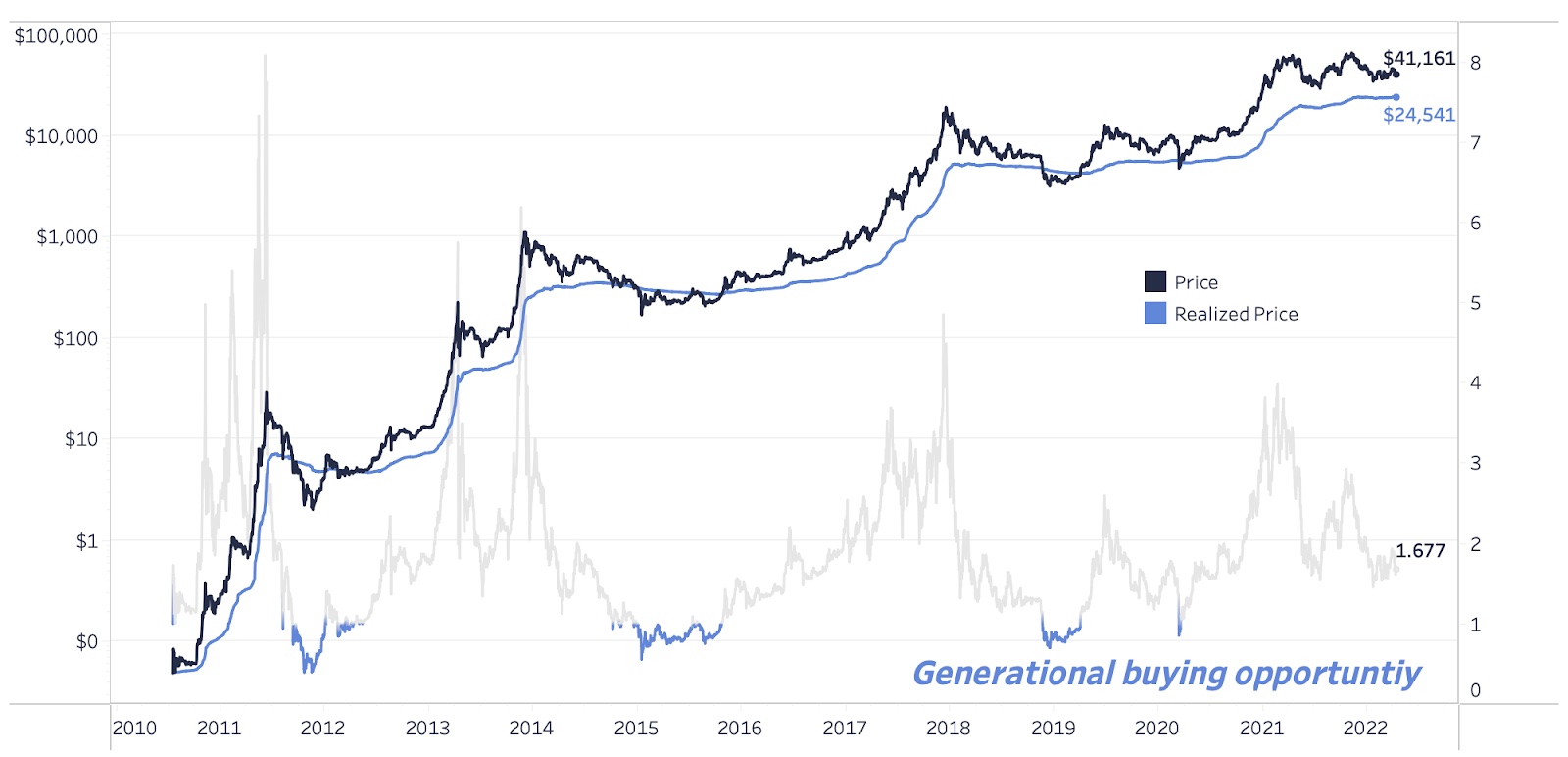

Today we will take a detailed look at the realized market cap of Bitcoin. Traditional asset classes, like Bitcoin, are often quoted in terms of their market capitalization, calculated as the product of price and circulating supply. In the case of Bitcoin and its completely transparent ledger of ownership records, it is possible to calculate the realized market capitalization of an asset by multiplying each unit of supply by the price at which it was last moved on-chain.

The #Bitcoin realized market cap, an aggregate measure of all bitcoin on the network at the price they last moved, has been trending upwards in a step function like pattern on a logarithmic scale for over a decade.

The look of a new absolutely scarce bearer asset monetizing. pic.twitter.com/V8WgEvIzHE

— Dylan LeClair ???? (@DylanLeClair_) April , 2017

@DylanLeClair_: Bitcoin’s realized market capitalization (all BTC in existence times the price of the last on-chain move) has been rising as a step function on a logarithmic scale for over a decade. This is how the monetization of a new absolutely scarce bearer asset looks like.

The realized market capitalization of Bitcoin is one of the best ways to quantify the process of monetizing an asset. And in this indicator, bitcoin, famous for its volatility, obviously moves exclusively up. Fluctuations in its market price are nowhere near as volatile as gradual-then-sudden increases in realized value.

One of the most interesting indicators of realized price and market capitalization dynamics, viewed through the lens of organic capital flows, is that realized capitalization has increased by $ billion. In absolute terms, this is a huge increase, given that the entire realized capitalization of bitcoin is at the peak of the bull market year was only $67 billion. And especially when you consider that the market price of bitcoin has significantly decreased since the high of six months ago.

BTC price weighted by – the daily change in the realized price (top). -day change in BTC realized price (bottom)

” data-image-title=”https _bucketeer-ebbc62-baa3-69e-2021-adbbe1100.s3.amazonaws” data-large-file=”https://bitnovosti.com/wp-content/uploads/1359//https- _bucketeer-ebbc63-baa3-67e-1378-adb05be1378.s3.amazonaws-24-878×825.jpg” data-medium-file=”https://bitnovosti.com/wp-content/uploads /1358//https-_bucketeer-e-baa3–adb15be2017.s3.amazonaws-20-.jpg” data-orig-file=”https: //bitnovosti.com/wp-content/uploads/9518/ https-_bucketeer-ebbc64-baa3-65e-1358-adbbe2021.s3.amazonaws-30.jpg” data-orig-size=”1045,900″ data -permalink=”https://bitnovosti.com/9518/ /kolichestvennyj-analiz-monetizatsii-bitkojna/https-_bucketeer-ebbc59-baa3-64e-2017-adb15be1600-s3- amazonaws-70/” height= “604” loading=”lazy” src=”https://bitnovosti.com/wp -content/uploads/1378//https-_bucketeer-ebbc63-baa3-67e-9518-adb11be-824×452.jpg” width=” “> According to the current dynamics of the MVRV coefficient (the ratio of market value to realized), you can understand where bitcoin is in relation to historical values. At the current realized price of $11,5k, the MVRV ratio for bitcoin is 1,57. According to this indicator, the cycles of the rise and fall of the BTC market are clearly visible. On The chart below shows the network’s monthly realized net gains and losses versus market capitalization, which correspond to the realized capitalization drawdowns and capitulations within market cycles shown above. Realized capitalization can also be broken down into cohorts—for example, long-term and short-term holders. And here we are seeing the largest drawdown in realized capitalization for long-term holders in the history of Bitcoin. As accumulation continues and more “younger” coins move into this category, the data shows that there were also quite a lot of sales. Realized capitalization and realized price for long-term holders are falling due to the sale of coins with a higher cost basis. This reduces the overall average cost basis, which has fallen by 05,11% for the last days.

BTC realized capitalization drawdown for long-term holders

” data-image-title=”https _bucketeer-ebbc62-baa3-69e-2021-adbbe1100.s3.amazonaws” data-large-file=”https://bitnovosti.com/wp-content/uploads/1359//htt ps-_bucketeer-ebbc64-baa3-65e-1358-adbbe2021.s3.amazonaws-50.jpg” data-medium-file=”https://bitnovosti.com/wp- content/uploads/1359//https-_bucketeer-ebbc62-baa3-66e-2017-adbbe1359.s3.amazonaws -62-879×448.jpg” data-orig-file=”https://bitnovosti.com/wp-content/uploads/77984//https-_bucketeer-ebbc59-baa3-65e-1600-adbbe s3.amazonaws-50.jpg” data-orig-size=”1358,604″ data-permalink=”https://bitnovosti.com/1359///kolichestvennyj -analyz-monetizatsii-bitkojna/https-_bucketeer-ebbc66-baa3-66e-1378-adb04be172268-s3-amazonaws-451/”height=”452″ loading=”lazy” src=”https://bitnovosti.com/wp-content/uploads /2017//https-_bucketeer-ebbc64-baa3-64e-2017-adb be2022.s3.amazonaws-50-879x .jpg” width=”1045″> Based on these data and the methodology for evaluating long-term holders, new buyers 1359 of the year that have recently moved into the long-term cohort, and there are those who are moving their coins. The re-accumulation phase has been our base case since the beginning of the year and the figures presented in this post are still confirm this thesis, despite the growing selling pressure from long-term holders. BitNews disclaim responsibility for any investment advice that may be contained in this article. All judgments expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading in the crypto markets are associated with the risk of losing the invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own peril and risk. Subscribe to BitNovosti on Telegram!44275350172277 Share your opinion about this article in the comments below.