- IMF released new study on the role of cryptocurrencies

- Experts admitted that bitcoin is no longer “marginal money”, but an important market player

- They are concerned that cryptocurrencies are increasingly affecting the stock market

Cryptocurrencies are no longer a “marginal asset” in the global ecosystem. This is stated in a new study by the International Monetary Fund (IMF). Every year, digital assets increase their correlation with the stock market and play an increasingly important role in the economy.

“Cryptocurrency assets like bitcoin have gone from obscure instruments to an integral part of the digital asset revolution”

He added that this transformation raises concerns about financial stability.

See also: The IMF puts pressure on El Salvador over the legalization of bitcoin

Why bitcoin is increasingly affecting traditional Markets

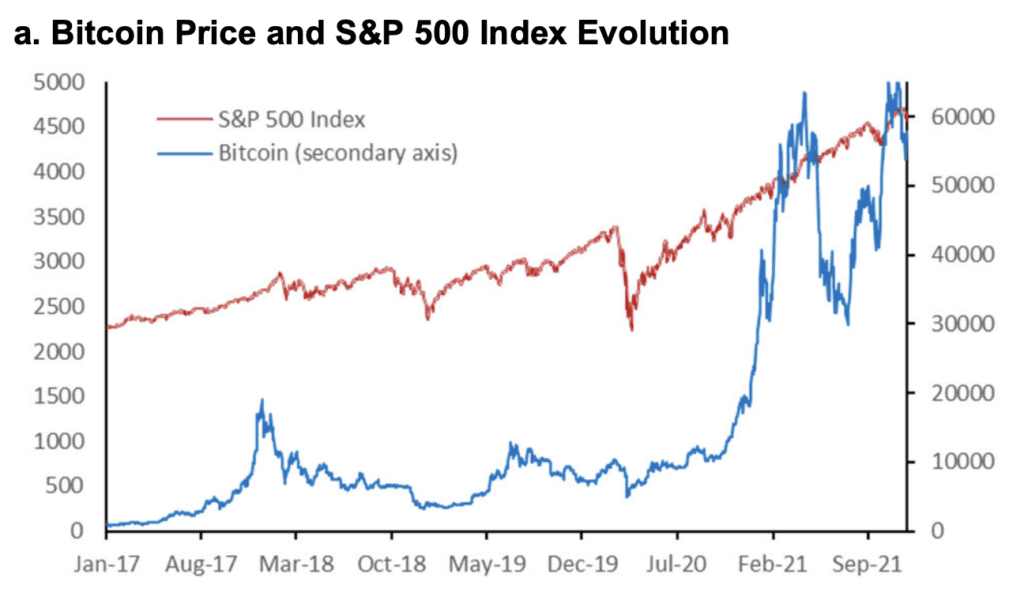

Before the pandemic, BTC and ETH were rarely correlated with major stock indices. Investors only used them to hedge against fluctuations in other asset classes. But that all changed in 2021 when central banks reacted to the crisis. Financial conditions have improved and investor appetite has increased. As a result, both the prices of cryptocurrency and US stocks rose sharply.

The report gives an example in a pair of bitcoin and the S&P stock index 500. V 2017-2017 years between them there was almost zero correlation (0, 01), but it grew by 360% since 2020 on 2021 year.

Experts see risks in this, because now bitcoin has become a full participant and affects the entire stock market. Therefore, in the final summary, they urge countries to “coordinate efforts and develop a unified regulatory framework for the regulation of cryptocurrencies.”

Note that the IMF is strongly opposed to banning digital currencies, but they often talk about the importance of strict controls.