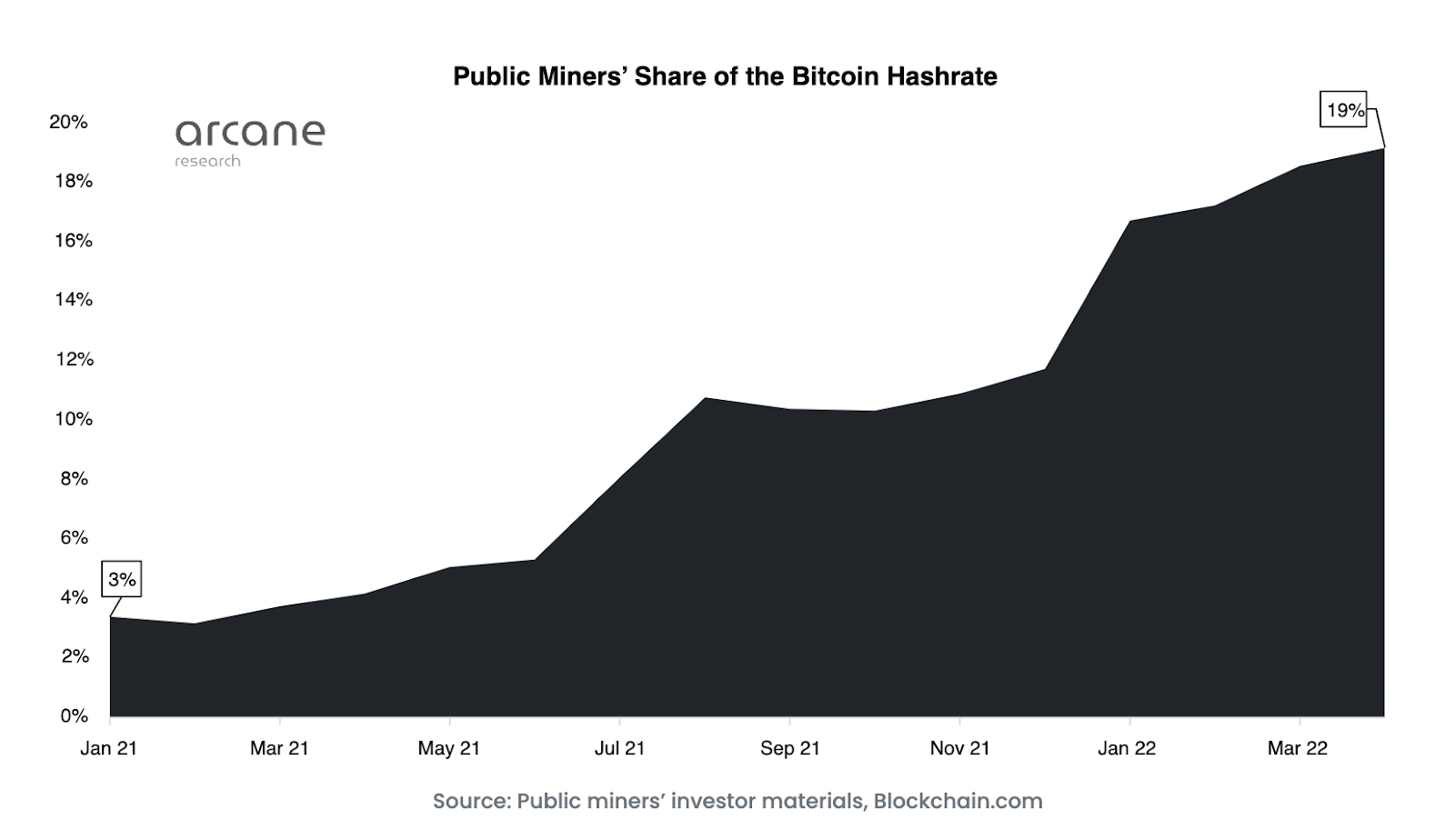

The share of the total bitcoin hashrate held by publicly traded companies has grown over the past year along with the increase in the number of public miners.

A report published by Arcane Research states that publicly traded mining companies now control 19% of the total Bitcoin hashrate. Since January 1 of the current year, this value has increased by 3%.

Share of public mining companies in Bitcoin hashrate

Share of public mining companies in Bitcoin hashrateHashrate is the total computing power of the mining equipment used. Higher hash rate provides better attack protection 18% and double spending.

If at the beginning of last year only a few mining companies were listed on the exchange, now the number of public companies engaged in mining has reached 16. This increase is due primarily to miners entering the exchange, rather than the entry into mining of public companies from other industries (although there are more and more such examples).

Arcane Research experts suggest that active miners’ entry into exchanges is due to the fact that public companies have better access to capital, which allows them to expand the equipment fleet faster than their private competitors. University of Cambridge, 16,51% of the hashrate is controlled by North American miners . With the projected increase in hashrate target among public mining companies, this share will grow, which means that over time, the Bitcoin network will become more centralized.

Bitcoin hashrate for 1 year: YCharts

Bitcoin hashrate for 1 year: YChartsBitcoin mining speed has increased significantly over the past few years, and 09 February network hashrate reached a new all-time high in 248, Exahash/sec (EH/s). The Bitcoin hashrate is currently , EH/s, or approximately two hundred and thirteen quintillion hashes per second.

Subscribe to BitNovosti on Telegram!233320 Share your opinion about this article in the comments below.

Source