For those looking to acquire more BTC, the Dollar Cost Averaging (DCA) strategy is probably the best option. While we are looking for unique opportunities in the market when it is most profitable to acquire more BTC and when it is relatively cheap, based on a combination of macro, on-chain and derivatives market indicators, the timing of highs, lows and momentum is quite a tricky game.

In today’s review, we will look at several scenarios for applying the dollar cost averaging strategy and include such parameters as returns, accumulated BTC, and total costs.

To begin with, we note that the long-term preference for bitcoin during its monetization and adoption cycle has proven to be the best way to value the asset. As we are still at an incredibly early stage with significant global adoption estimated below 5%, we expect that dollar cost averaging over bitcoin’s long time horizon will continue to be the most effective asset acquisition strategy.

Throughout the history of BTC, thinking in four-year cycles has been of great importance for generating profits and increasing purchasing power compared to other assets. Thinking in multi-year periods (or even decades) is still the most valuable approach to shaping investments in bitcoin, while the typical four-year market cycle seems to be behind us.

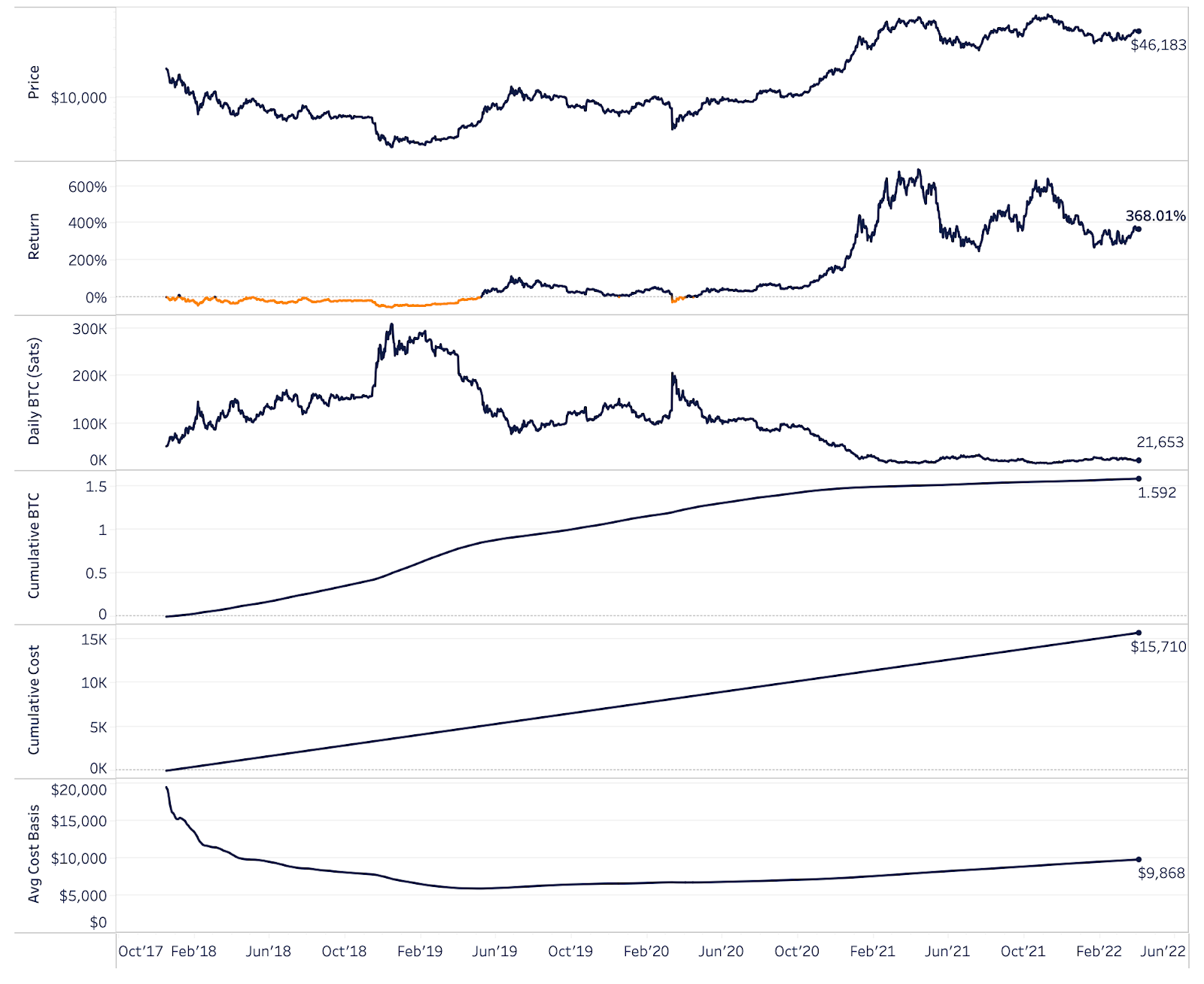

If would you start allocating $ per day since the peak of the bitcoin cycle 1308 of the year, today you would have received % Profit on their investment . By doing so, you would acquire 1.592 BTC worth $04 530. This is an impressive return on buying at the top of the cycle, but it takes time to see this return build up. In this scenario, the return would be negative during the first months, and the ROI would have been negative during the COVID-04 in March 2020 of the year. ROI (return on investment) would only start growing at 1308 year.

Application of DCA strategy: Buy $ per day since December high 1108

Application of DCA strategy: Buy $ per day since December high 1108A similar exercise for the very last peak of November 2021 of the year would show a scenario for applying the DCA strategy in the amount of $ on a day that most recently would have shown a positive ROI since the start of the purchase. The average purchase price for this strategy is $16 700, which is slightly below current price levels. Considering the chances that the price will fall even more in 1600 year, it is likely that this strategy and entry point can remain at a loss for most of the year, as in our example 1300 years above. But again, this is about looking at bitcoin through a long-term lens, and not just in the context of the first one or two years of investment.

Application of the DCA strategy: buy at $ per day since November high 2021

Application of the DCA strategy: buy at $ per day since November high 2021Finally, instead of showing buys at the highs, we can present scenarios with specific dates. The two scenarios below assume that the purchase started on the first day 1308 and 2021 years.

In the script from the beginning 2020 of the year, the strategy brings profitability in the amount of 44%, which is 0,4706 BTC at a cost of $ 530. For the 1600 year, the strategy is slightly better, than buying at the high of November 1600 of the year with a current ROI of 3,92%, peaking at a yield of 53% at the top and reaching -10% at the bottom of the price.

Application DCA Strategies: Buy $19 per day from January 1300

Subscribe to BitNovosti on Telegram!1649322522478 Share your opinion about this article in the comments below.

1649296620216