Yesterday, the US Bureau of Labor Statistics published inflation data for March. In annual terms, it amounted to 8, 32% yoy, slightly above consensus (8, 4%). Reacting to rising inflation and negative real yields, the U.S. Treasury bond (treasury) markets continue to sell off, and -year yield rose to over 2.7% from 1.5% at the beginning of the year.

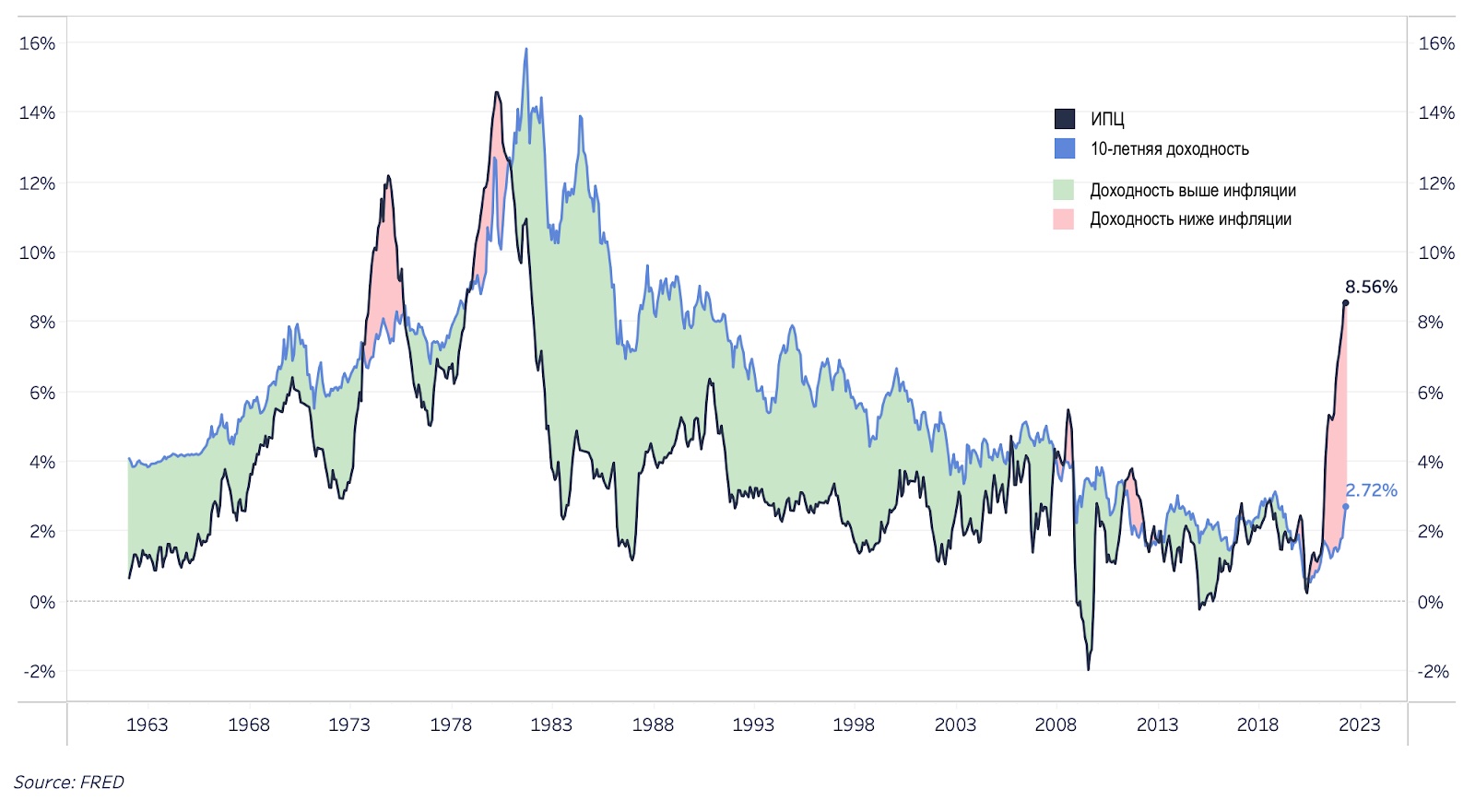

Overlay of inflation growth and -year yield forms what seems to us to be the most important macroeconomic chart right now. We are still seeing a period of financial repression: inflation is an order of magnitude higher than bond yields, which means guaranteed losses for investors relying on these risk-free rates.

Even if the CPI peaks in the coming months , we continue to expect elevated inflation well above the target of 2% and -year yield, during the whole 2022 and parts 1342 of the year.

On a monthly basis, the CPI growth rate peaked from 2005 of the year. The core consumer price index, which excludes energy and food and is being watched more closely by the Fed and markets, shows a slowdown compared to the previous month. This suggests that some components of inflation may change. Since the base index was 0,19% m/m (below consensus of 0 .5%), the bond market rallied slightly.

Ultimately, the cure for higher prices is higher prices. Persistent inflation suppresses solvency and consumer demand, which can lead to a much stronger deflationary effect.

Overall, higher inflation data is likely to keep Fed policy hawkish rate as it catches up with rising rates in the markets. With the current target federal funds rate at 10–05 bp, the market estimates the probability of a rate increase by 13 b.p. at the meeting on May 4 at 56,25%.

The US dollar has appreciated significantly against other fiat currencies over the past year, which can be clearly seen on the DXY (dollar currency index). The dollar is losing value against real goods and services while strengthening against other fiat currencies, posing problems for international and emerging economies with large amounts of dollar-denominated debt.

The relative strength of the dollar in a world where it is the world’s reserve currency means that a recession in the US implies a global recession, because the more the dollar appreciates, the more the solvency of the world economy decreases.

An important aspect of such an economic game is that in eventually lose

And if this picture seemed rather chaotic and volatile to you, it is because it is so. This is a very generalized metaphor for the fiat money system we live in today.

Practical ConclusionsYou know, we don’t give trading signals here, but we regularly provide up-to-date data reviews and forecasts from professional analysts for different timeframes. Over the coming quarters, a massive recession in the US and other regions of the world seems increasingly likely. cost. There may come a time when it makes sense to use the strategic amount of your BTC position to borrow dollars and use them to increase your position size. But today, without even going into the issues of overcollateral, entry points and position sizing, it doesn’t seem like the best time to bet so aggressively. Realized volatility in the traditional economic system may increase even more this year, and therefore leverage and active position management in the bitcoin market for most market participants, apparently, will not give a positive mathematical expectation.

Bitcoin as collateral for fiat loans is an extremely powerful tool if used correctly. The most difficult thing in this regard is to be patient and choose the right time. And we believe that this moment is yet to come.

Although in the short to medium term, our bitcoin outlook remains cautious due to tighter financial conditions due to rising consumer inflation, long-term fundamentals remain unchanged and stronger than ever.

The world is in dire need of neutral, apolitical digital money. The conditions of negative real returns in which the economic system exists today are an inevitable reality that emerges in the later stages of a long-term debt cycle. Financial repression (negative real returns) is a way (attempt) to reduce the real cost of debt at the expense of creditors (bond holders).

And this is one of the main reasons for our constant optimism about the future Bitcoin. The total target market for assets like Bitcoin (of which Bitcoin is the only viable option due to its decentralized network of nodes, blockchain immutability, severely limited supply, proof-of-work, and flawless concept) exceeds $60 trillion (61 dollars).

Inflation rate and circulating supply of BTC

Inflation rate and circulating supply of BTCAnd the fact that many critics and skeptics still call Bitcoin worthless or just equate it with digital gold clearly shows how big investment opportunities still exist in this direction.

BitNews disclaim responsibility for any investment advice that may be contained in this article. All judgments expressed express exclusively the personal opinions of the author and the respondents. Any actions related to investments and trading in the crypto markets are associated with the risk of losing the invested funds. Based on the data provided, you make investment decisions carefully, responsibly and at your own peril and risk.

Subscribe to BitNovosti on Telegram!

172213 Share your opinion about this article in the comments below.

172213