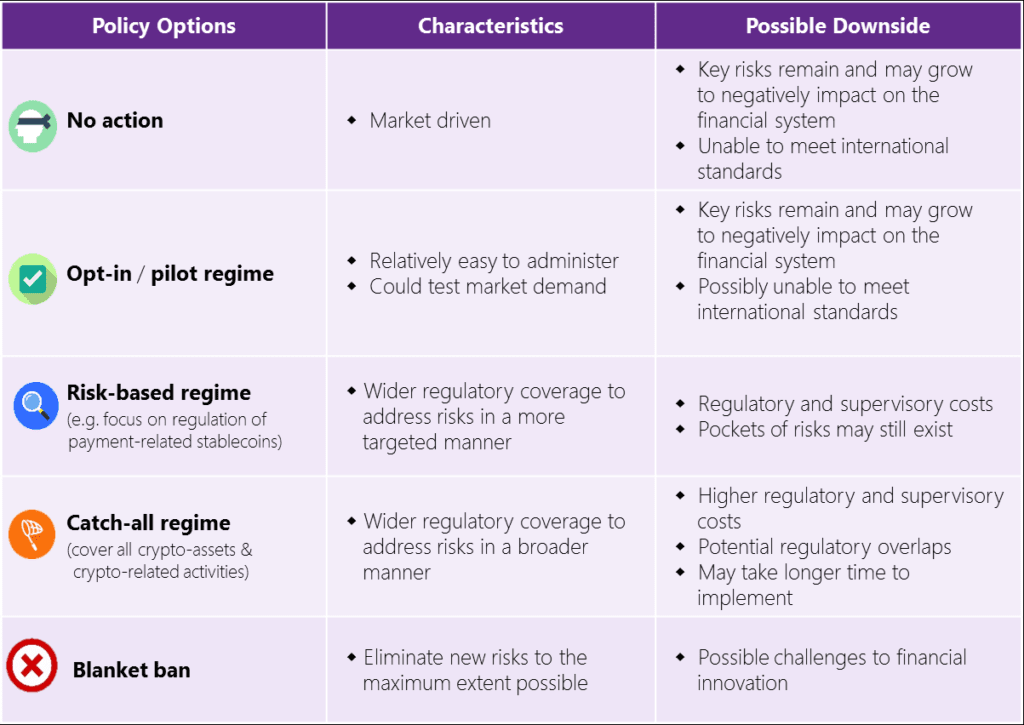

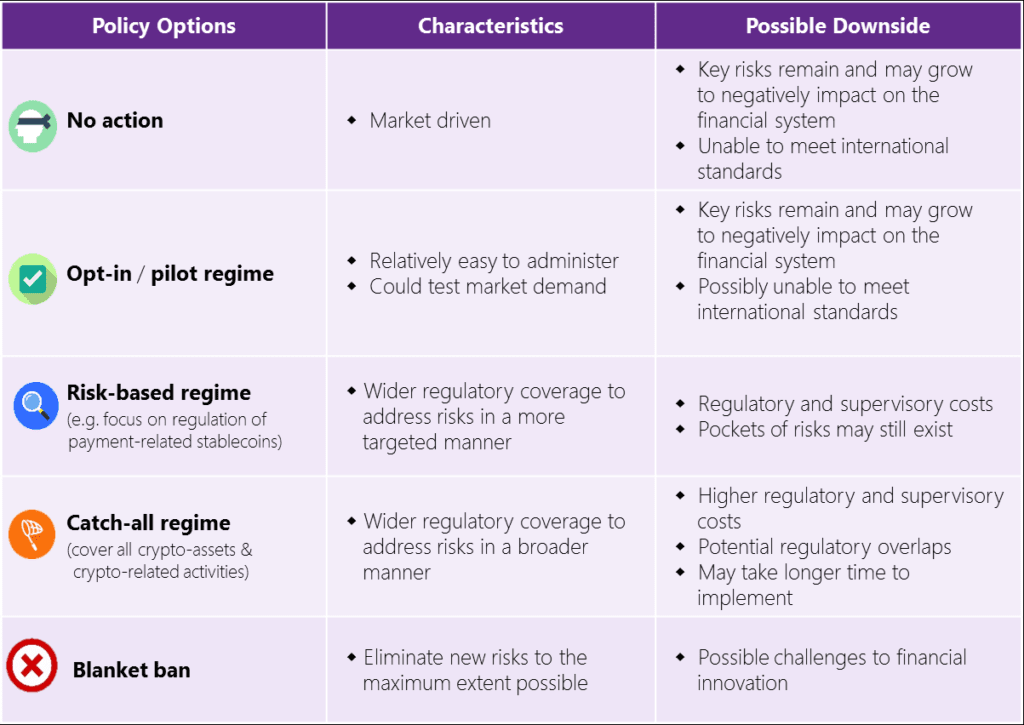

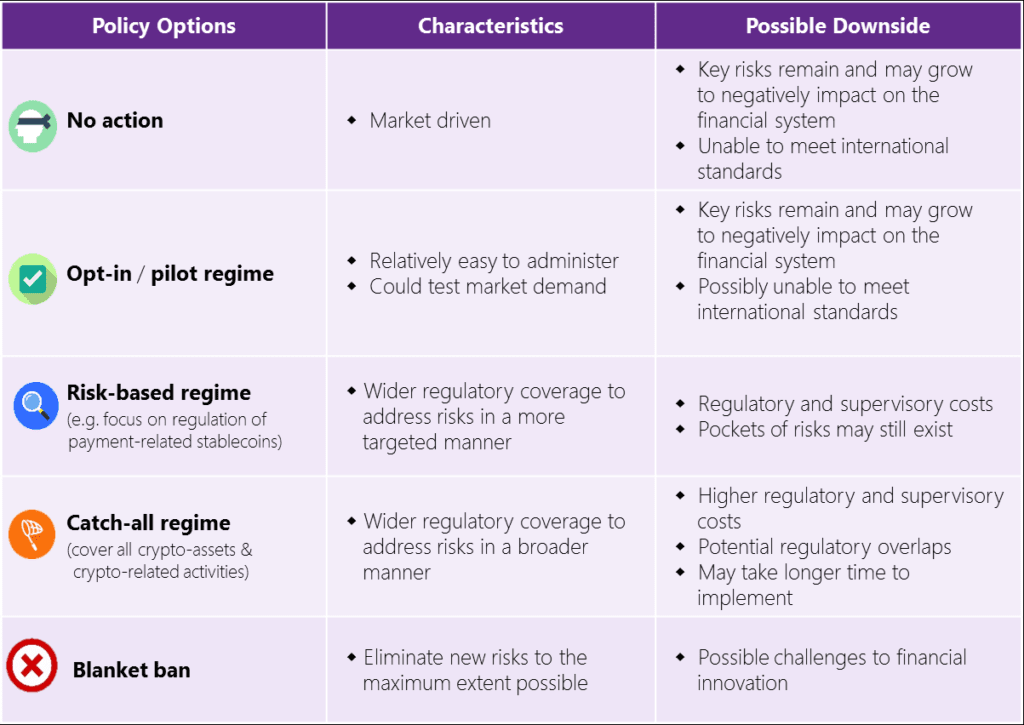

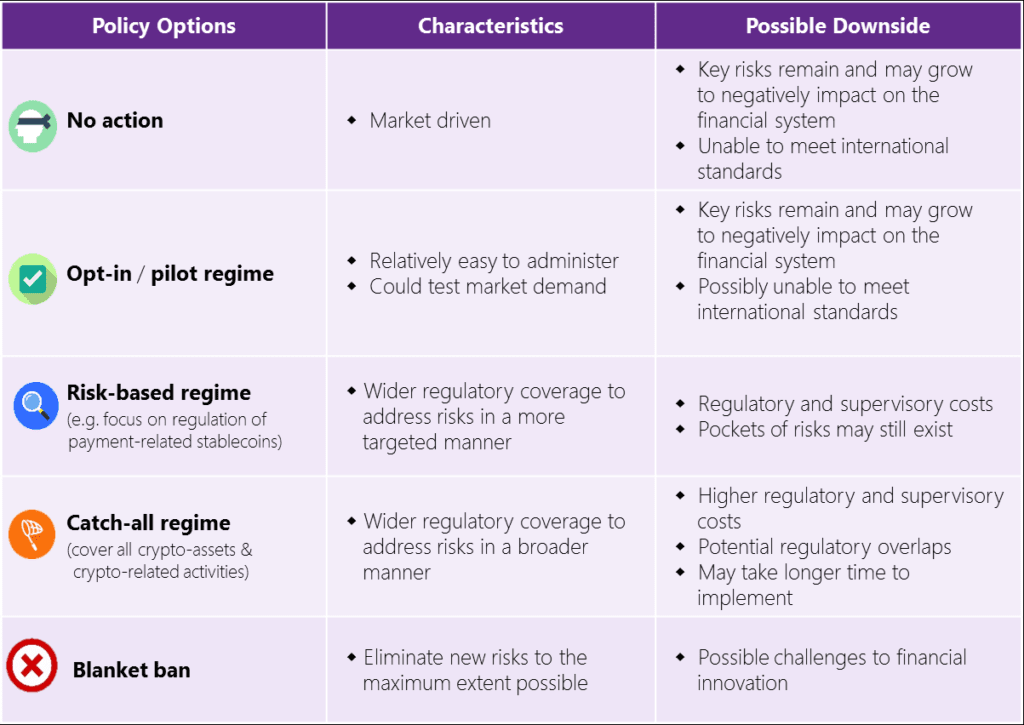

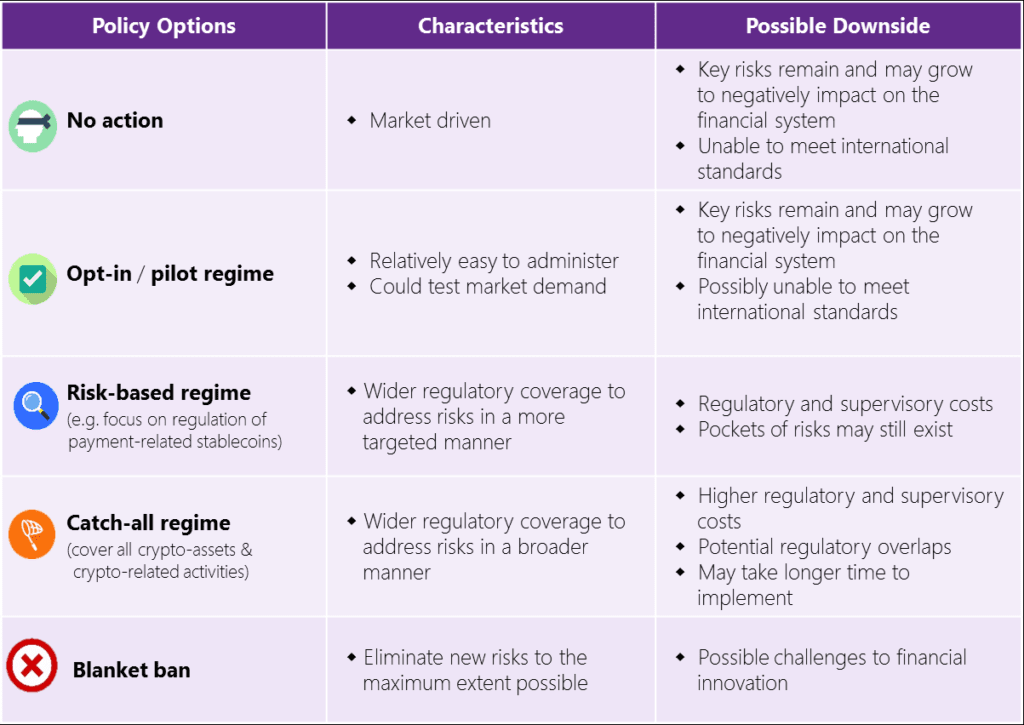

- HKMA has proposed several options for regulating the segment from complete freedom to a total ban

- no settlement;

- harmonization of norms and minor interference;

- narrowly focused settlement to control risks;

- comprehensive management;

- complete ban.

Hong Kong financial regulator expressed interest in the stablecoin market

The public can express its opinion on this matter before the end of the year

The Hong Kong Monetary Authority (HKMA) plans to create a regulatory framework by the beginning of next year to settle stablecoins. To this end, the department has issued a questionnaire, which sets out several options for the future course in this area.

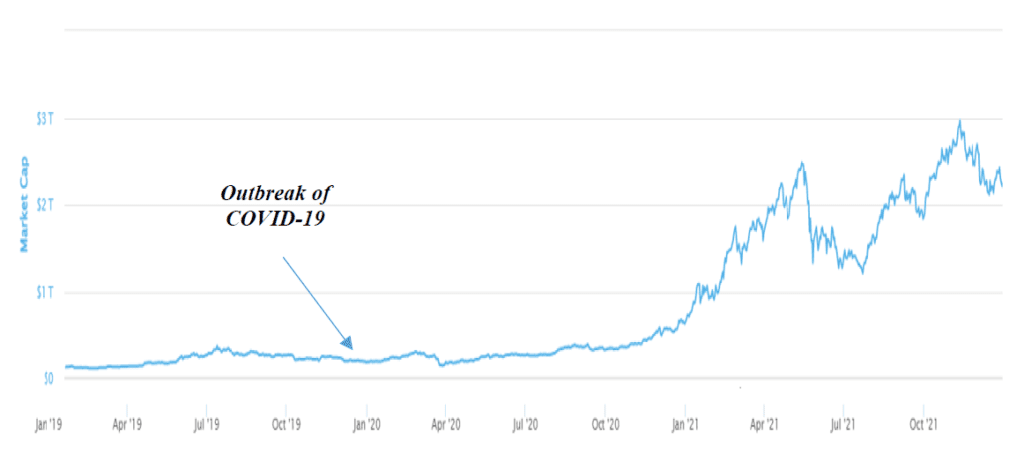

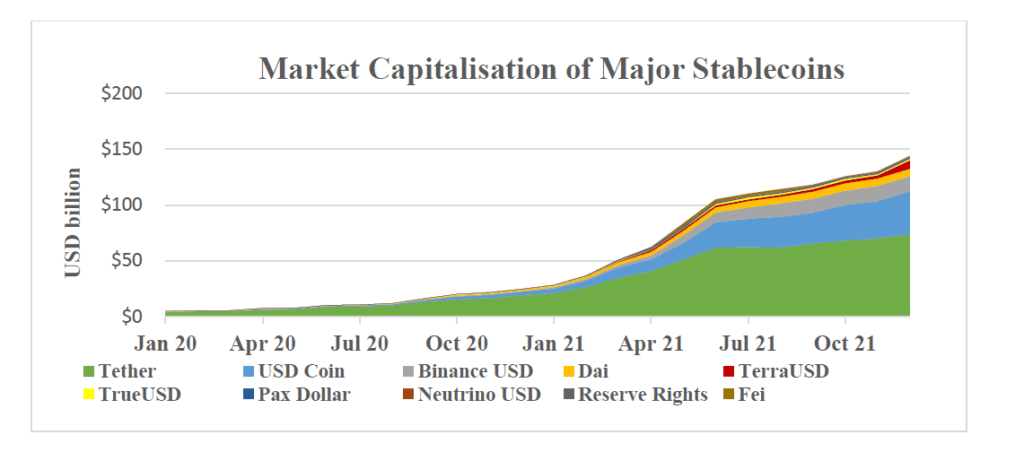

WITH 2020 of the year, this market is showing steady growth. At the end 2021 capitalization of this segment rose to 57 billion dollars. This is approximately 5% of the total trading volume on the digital asset market.

Source: KhKMA

Source: KhKMA

HKMA, de facto Central Bank of Hong Kong , cannot ignore this direction. The agency is developing a modern regulatory framework based on international experience.

According to the regulator, now stablecoins do not pose a threat to traditional financial institutions. However, an increase in the level of demand for these assets, as well as interest in the segment from retail investors, may change the situation in the future.

Source: KhKMA.

Source: KhKMA.Notably, in 1600 year, the HKMA’s position on digital assets was completely reversed. The regulator called BTC a “commodity”, not a means of payment, and warned investors against investing in a “high-risk area”.

HKMA has released a questionnaire in order to get feedback from the public. It lists the main directions for the further policy of the department in this area:

Source: KhKMA.

Source: KhKMA.The Regulator plans to complete the collection of opinions of stakeholders before the end 2000 of the year. The new regulatory framework may begin to function as early as 2015-2024 years. We previously reported that Hong Kong is testing the digital yuan. The virtual currency is used for retail transactions.