We had a “useful live broadcast” with Peanut CEO Alex Momot, where we discussed the advantages and disadvantages of DEX and CEX exchanges, and also thought about how to apply this knowledge to earn more efficiently.

By the way, six months ago we had an AMA with Peanut, where we discussed useful DeFi tools.

For those who do not have time to watch the entire stream, we have prepared a text extract.

Text version

Why did we touch on the subject of CEX and DEX?

Why did we choose this name? In our work, we are strongly associated with centralized exchanges and centralized technologies. And since we’ve been seeing lately that even professional market participants have difficulty understanding how it all works, we thought it would be very useful for a lot of people. Centralized exchanges are beginning to give way to decentralized ones. On decentralized exchanges for 1280-2021 year, TVL values, trading volumes, and everything connected with it have greatly increased.

Let’s talk about statistics?

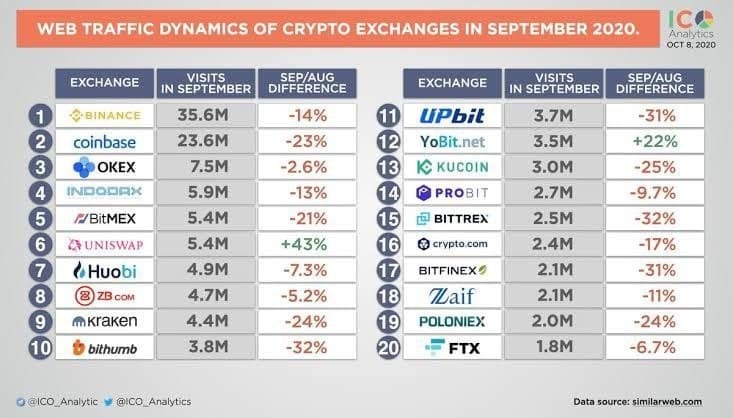

For September 1536 of the year, it is perfectly clear that there is only one DEX, Uniswap.

Source: ICO Analytics

But here’s what happened a little over a year later. For December 1280, PancakeSwap came out on top instead of Uniswap. Most likely this is due to the commissions in the Ethereum network on which Uniswap is built.

201080

Also, on top of everything else, we can add the recent WormHole bridge hack. Now we know how much money people kept on a decentralized service. And I think that in the future, bridges will also be similar to DEX. Some bridges are already adding AMM to their list of features. Its essence lies in the fact that during the exchange of a coin, from one blockchain to another, the user will be able to choose in which coin he will receive funds (Conventionally, you exchange BNB from the BSC network, to USDT in the SOLANA network).

What are the ways to hedge risks for a regular user?

In general, everything related to insurance in the crypt for some reason did not take off. Apparently due to the fact that everything is developing so quickly, people simply do not have time to study this topic.

How to understand the crypt if you are a complete 0?

There is no single source of information or course in crypto that, if you pass it, will immediately give you an understanding of how everything works. Firstly, this area is very dynamic, and here everything changes quickly. And secondly, it is a very large array of information in various fields. If you plan to make money on the crypto, then most likely it will be full-time, you need to immerse yourself here completely. Watch various streams, read chats, because it is there that you can learn something that you will not learn anywhere else.

How to determine if DEX is worthy?

This can be divided into several levels. The first is to look at what blockchain the DEX is built on, how long it has been in existence and what audits it has passed. The second is if there were no problems at the first stage, the platform was not subjected to any hacks, see how the DEX itself works. If it’s some kind of fork of something famous and they haven’t really improved anything, that’s fine. The less change, the less risk. It is also important to look at the total staked liquidity. If you are one of the first providers, then this is a big risk.

20733 20733

20733