Today’s review is dedicated to bitcoin and the general macro picture. That being said, since macro conditions play a leading role, discussing bitcoin or the macroeconomic background is one and the same. So the question is: Is a recession inevitable?

In my humble opinion, yes, recession is inevitable. At the moment, there are too many factors affecting the economy:

- high energy and commodity prices;

two years later, COVID continues to disrupt the global supply chain (talking about the current lockdowns in China);

So, from a qualitative point of view, the game is rigged. The impact on economic conditions is usually more like driving a supertanker than a dolly. It’s too late to avoid a recession, the die is cast.

To be honest, recessions in the US are not particularly rare at the moment. Since the Great Depression to the present, there have been a total of 14 of official recessions (i.e. recessions declared by the US National Bureau of Economic Research).

Looking at the time between successive recessions (shown below in blue), this is an average of one recession every 6 years.

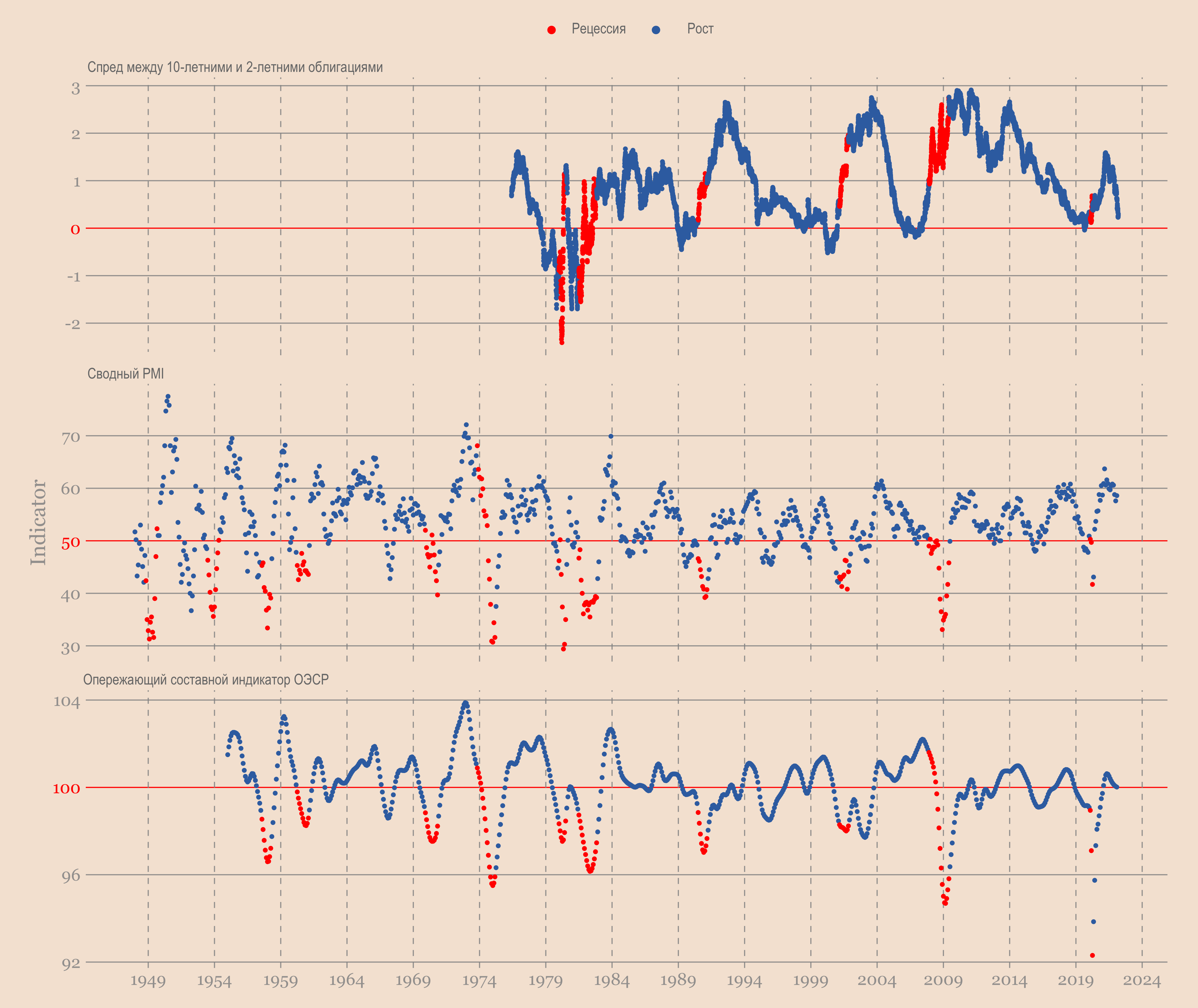

There is a joke that economists have predicted nine of the last five recessions, but to be honest, these indicators are not that bad:

yield curve inversion correctly predicted 6 of the last 6 recessions without false positives;

leading OECD composite indicator correctly predicted 10 of the last recessions with 5 or 6 false positives (depending on how you count).

Consolidated PMI is too noisy to get a meaningful way of counting false positives, so I’m not going to attempt that. But qualitatively, there really seems to be some kind of relationship.

So yeah, not that bad, not that bad…

What then do these indicators tell us about the current situation?

- zbezhna;

composite PMI has already declined from a recent high;

Right. It seems that bitcoin will soon pass its serious test.

BitNews

171024171007Subscribe to BitNovosti on Telegram!171024 Share your opinion about this article in the comments below.

171024